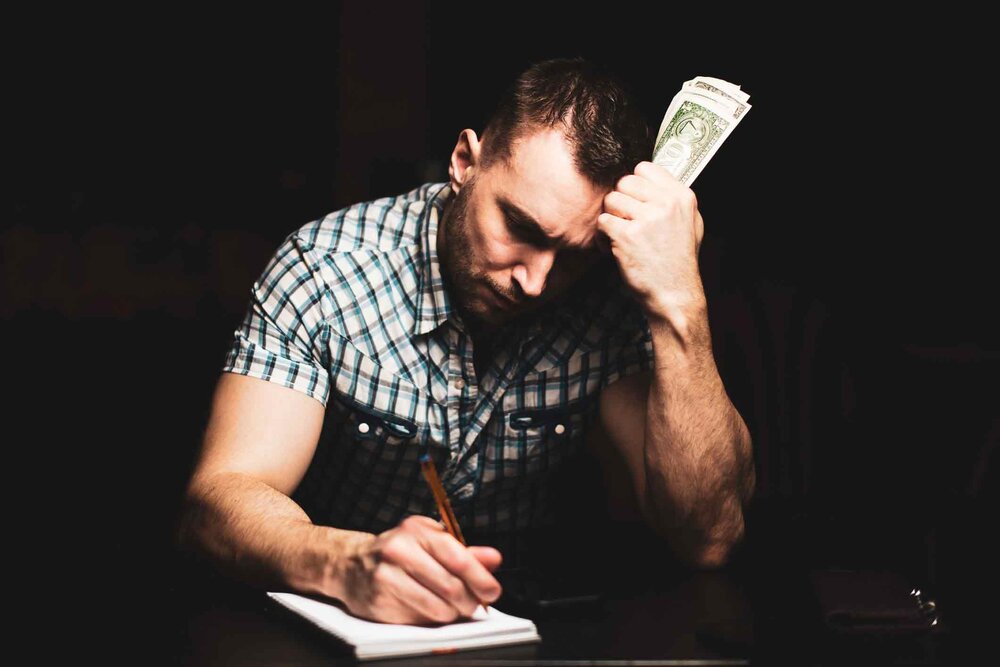

Is Financial Stress Making You Sick And Tired?

By: Michelle Bogle

Losing sleep about money won’t make your troubles go away.

It’s past midnight and you know you should be sleeping, but your brain is on overdrive and your body is restless. Your credit card is past due and your bank account is in the red. Your oldest is also applying to post-secondary schools, but you don’t know how to tell her that there’s no education fund. Then, there’s the money you owe your brother.

You are tired, guilt-ridden and stressed. But, you are not alone. Many firefighters face pressures managing their debts and day-to-day finances. According to the 2019 Canadian Financial Capability Survey:

- Nearly three-quarters of Canadians have some type of outstanding debt or have used a payday loan service in the past year

- Almost one-third believe they have too much debt

- One in six say their monthly spending exceeds their income

- One in four borrow to buy food or pay for daily expenses

How we manage stress is important

As a firefighter, your body is no stranger to stress. Each time you get a call, a rush of adrenaline and cortisol — a stress hormone — kicks in. You feel alert and energized as your heart races in your chest. Even hours after your shift, it takes time for your body to readjust from fight or flight mode to a neutral state.

This type of stress is hard physically and mentally, but it is not unique to firefighting. Ongoing financial stress can have serious consequences too. Unmanaged high cortisol levels put you at risk for health conditions, like cardiovascular disease, osteoporosis, psychiatric disorders, insulin resistance and diabetes. Since stress is part of your job, you need to find ways to mitigate it in your personal life — and if money is adding to your problems, it’s time to get serious.

So how can you manage financial stress?

- Set up a budget: A budget is your roadmap for how to spend your money. It can help you avoid late bill payments, stay on top of your debts, have enough cash for necessities, like food, clothing and shelter, and save for the future.

- Identify your biggest triggers: Whether it’s overspending, not paying bills on time, growing debt or saving for retirement, focus on the main sources of your financial anxiety first so you stay motivated and in control.

- Plan for emergencies: Maybe it’s a pricey car repair or your furnace dies on the coldest day of the year? Either way, unexpected expenses will catch you off-guard. Having an emergency fund — even just $1,000 — can help you to sleep better at night and take on less debt and money stress.

- Be honest: Money problems can lead to withdrawal from friends and family, and it’s often the prequel to divorce. Instead of carrying the burden on your shoulders alone, lean on your relationships to stay on track. Accountability and support can go a long way.

Losing sleep about money won’t make your troubles go away. Instead, learning how to identify your financial stressors and finding effective ways to deal with them can help you break the cycle. Start by taking small steps and watch your progress build. You only have health, wealth and happiness to gain.

Michelle Bogle is a freelance writer who specializes in copywriting and content writing.

Podcast

Contests & Promotions